Loan

Home Loan Refinancing in India: Top Lenders in 2025

Home loan Refinancing, commonly referred to as home loan balance transfer in India, is becoming an increasingly popular financial strategy among borrowers. Rising interest rates, better loan terms from competitors, or improved credit scores often lead homeowners to explore refinancing options to reduce their financial burden.

In this article, we’ll dive into what home loan refinancing really means in India, its benefits and risks, and the top banks and financial institutions offering refinancing in 2025.

What is Home Loan Refinancing?

Home loan refinancing is the process of transferring your existing home loan from your current lender to a new lender offering better interest rates or terms.

For example:

If you took a home loan in 2020 at 9.5% interest, and in 2025 another bank is offering a loan at 8.2%, refinancing allows you to shift to that lender and reduce your interest burden.

Why Do Indians Refinance Home Loans?

Indians refinance home loans primarily to benefit from lower interest rates, which can significantly reduce monthly EMIs and overall repayment costs. As financial awareness grows, many borrowers realize that even a 0.5–1% reduction in interest can save lakhs over the loan tenure. Additionally, improved credit scores or better income profiles often make them eligible for more favorable terms.

Refinancing also allows flexibility in loan tenure, switching from fixed to floating rates, and availing top-up loans for other needs like renovation or education. Poor customer service or hidden charges from existing lenders also prompt borrowers to switch for a better experience.

| Reason | Explanation |

|---|---|

| Lower Interest Rates | Save on interest over the long term |

| Better Loan Terms | Flexibility in tenure, part-prepayment or foreclosure |

| Improved Credit Score | Eligible for better offers than during the original loan application |

| Need for Additional Funds | Some lenders offer a top-up loan during refinancing |

| Poor Service from Current Lender | Better customer service and support at new institution |

How Much Can You Save?

Refinancing can save lakhs of rupees over time. Here’s a sample case:

| Particulars | Original Loan | After Refinancing |

|---|---|---|

| Loan Amount | ₹40,00,000 | ₹40,00,000 |

| Tenure | 20 years | 20 years (remaining) |

| Interest Rate | 9.5% | 8.3% |

| EMI | ₹37,285 | ₹34,365 |

| Total Interest Payable | ₹49.48 lakhs | ₹42.47 lakhs |

| Total Savings | ₹7.01 lakhs |

This is a simplified illustration. Actual savings depend on tenure left, new processing fees, and top-up amount (if any).

Things to Consider Before Refinancing

While refinancing seems tempting, it must be evaluated carefully.

Pros:

- Lower EMIs

- Reduced overall interest outgo

- Option to change tenure

- Top-up loans available

- Switch to floating/fixed rate as per need

Cons:

- Processing fees (usually 0.5%-1% of loan)

- Legal & technical charges

- Paperwork and time-consuming process

- May not be worth it for small remaining tenures

Tip:

Use a Home Loan Refinance Calculator to check whether the savings exceed the switching costs.

Top Home Loan Refinancing Lenders in India (2025)

Here’s a list of top Indian banks and NBFCs offering home loan refinancing, along with their indicative interest rates and features:

| Lender | Interest Rate (p.a.) | Processing Fee | Key Features |

|---|---|---|---|

| HDFC Bank | 8.35% – 9.20% | Up to 0.50% of loan | Quick processing, top-up loan option |

| State Bank of India | 8.30% – 9.05% | ₹10,000 max | No hidden charges, flexible tenure |

| ICICI Bank | 8.40% – 9.25% | Up to 0.50% | Pre-approved balance transfer options |

| Axis Bank | 8.50% – 9.30% | ₹10,000 + GST | Balance transfer + top-up combo |

| LIC Housing Finance | 8.45% – 9.40% | ₹5,000 onwards | Flexible tenure, easy documentation |

| Bajaj Finserv | 8.60% – 10.00% | Up to 1% | Top-up loan up to ₹50 lakh |

| PNB Housing Finance | 8.55% – 9.35% | 0.50% | Transparent processing, fast disbursement |

Rates as per trends in early 2025. Always verify current rates from official websites or advisors.

Documents Required for Refinancing

| For Salaried Individuals | For Self-Employed Individuals |

|---|---|

| PAN Card, Aadhaar, Passport | PAN Card, Aadhaar, Passport |

| 3-6 months Salary Slips | 2 years IT Returns, P&L Statement |

| Bank Statements (last 6 months) | Business Bank Statement (6–12 months) |

| Existing Loan Statement | Existing Loan Statement |

| Property Documents (Sale Deed, etc.) | Property Documents |

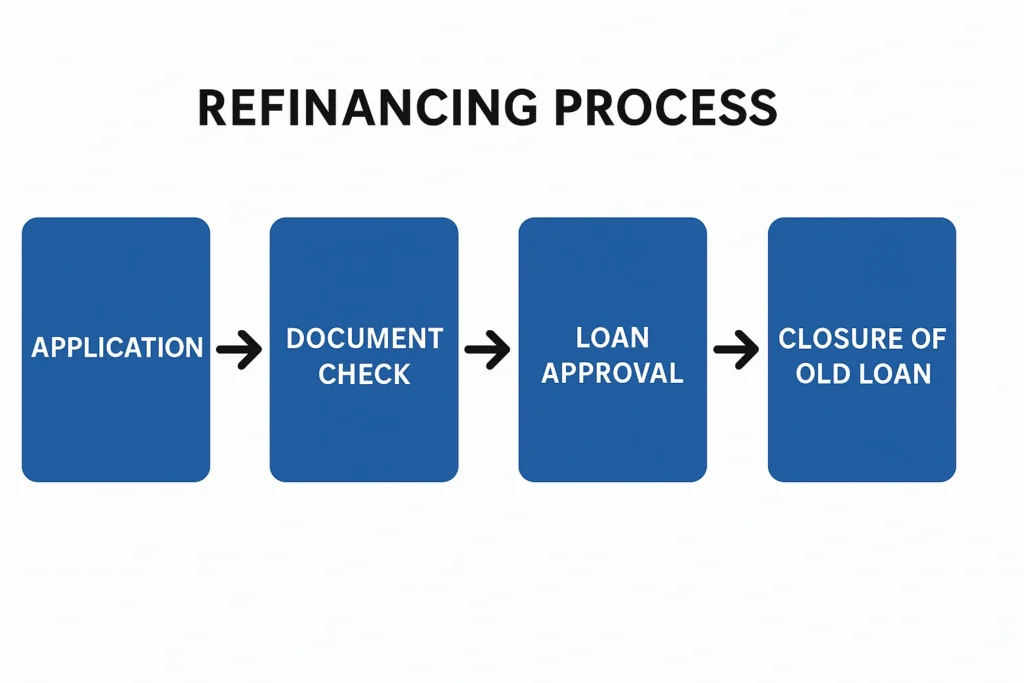

Home Loan Refinancing Process

The home loan refinancing process in India involves transferring an existing loan from one lender to another to avail better terms, primarily lower interest rates. It begins with submitting a refinancing application to the new lender, followed by a thorough document check including property papers, income proof, and existing loan details.

Once verified, the lender evaluates the applicant’s creditworthiness and approves the loan. Upon approval, the new lender disburses the loan amount, which is used to close the outstanding balance with the current lender. Finally, the borrower starts repaying the new loan under revised terms, potentially saving money over time.

Conclusion

Home loan refinancing in India is not just a trend but a financial opportunity—when done right. With interest rates now more dynamic than ever, borrowers can take advantage of the competition among lenders to negotiate better terms.

However, refinancing is not suitable for everyone. It must be assessed based on your remaining loan tenure, difference in interest rates, and costs involved in switching.

If you’re considering a refinance in 2025, start by checking your credit score, comparing offers from top lenders like SBI, HDFC, ICICI, and Bajaj Finserv, and calculate your potential savings using an online refinance calculator.

Application Form